Why Invest in Dubai: Top 9 Reasons

Why everyone is interested in Dubai Real Estate

Dubai has emerged as one of the most attractive real estate investment destinations in the world. Known for its tax-free environment, high returns on investment, and luxurious lifestyle, Dubai continues to draw investors from all over the globe. Whether you are looking to diversify your investment portfolio or purchase a property for personal use, Dubai offers numerous advantages.

In this article, we explore the top nine reasons why investing in Dubai real estate is a smart choice, the best areas for investment, the future of Dubai’s property market, and how Baytii can help you invest in Dubai seamlessly.

1. Tax-Free Environment

One of the biggest advantages of investing in Dubai real estate is the absence of taxes. Unlike many countries where property investors must pay capital gains tax, income tax, or inheritance tax, Dubai offers a tax-free environment. This allows investors to maximize their returns without deductions that typically eat into profits.

- No capital gains tax: Keep 100% of the profits when selling your property.

- No property tax: Unlike other global cities, Dubai does not impose annual property taxes.

- No rental income tax: Investors can enjoy full rental income without any tax deductions.

This tax-friendly environment makes Dubai a prime destination for real estate investors seeking high profitability.

2. Strong Rental Market

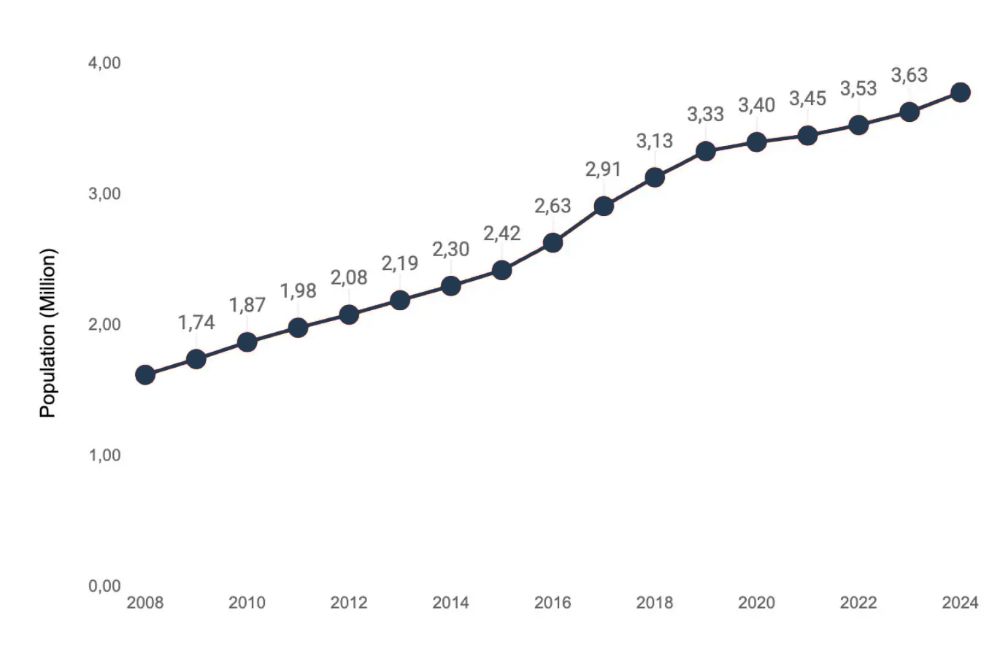

Dubai has a highly lucrative rental market, offering investors significant rental yields. The city’s rapidly growing population and influx of expatriates create strong demand for rental properties.

- High rental yields: Dubai offers some of the highest rental returns globally, ranging from 6% to 10%.

- Demand from expatriates: Over 85% of Dubai’s population consists of expatriates, ensuring a steady demand for rental properties.

- Short-term rentals: The booming tourism industry also supports high demand for short-term rental properties, especially in prime areas.

Whether you are investing in long-term or short-term rentals, Dubai’s rental market is one of the strongest in the world.

3. Strong Return on Investment (ROI)

Dubai real estate offers impressive returns on investment, making it a preferred choice for both individual and institutional investors.

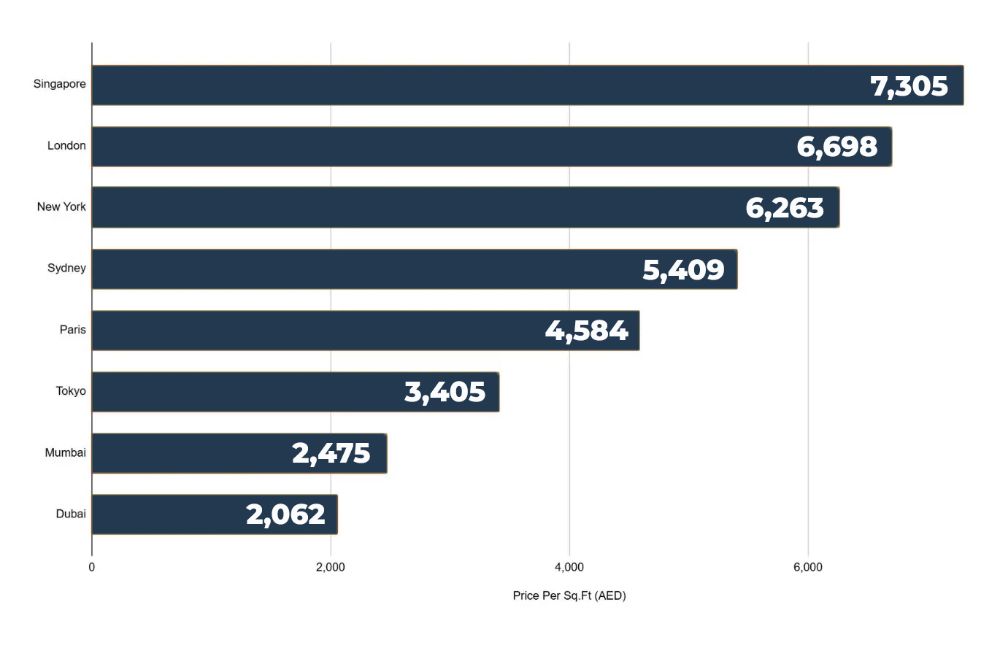

- Affordable property prices compared to other global cities: Investors can acquire luxury properties at relatively lower prices than cities like London, New York, or Hong Kong.

- Capital appreciation: Dubai’s real estate market has seen consistent price appreciation, driven by economic growth and infrastructure development.

- High rental income: Investors can expect strong rental returns, with many areas offering yields higher than the global average.

Investing in Dubai property ensures a combination of capital growth and lucrative rental income.

4. Thriving Tourism Industry

Dubai is one of the most visited cities in the world, attracting millions of tourists annually. This has a direct impact on the real estate market, particularly short-term rental properties.

- 9.31 million overnight visitors in the first half of 2024: Tourism continues to thrive, boosting demand for short-term rentals.

- World-class attractions: Landmarks such as the Burj Khalifa, Palm Jumeirah, and Dubai Mall contribute to its popularity.

- Growing hospitality sector: With Dubai hosting major international events, including Expo 2020 and COP28, the demand for accommodation remains high.

Investing in Dubai’s real estate allows property owners to benefit from the growing short-term rental market, fueled by the city’s strong tourism industry.

5. Competitive Property Prices and Payment Plans

Despite being one of the most luxurious cities in the world, Dubai offers relatively affordable real estate prices compared to other major metropolitan cities.

- Competitive price per square foot: Dubai properties are more affordable than those in London, New York, and Hong Kong.

- Flexible payment plans: Developers offer attractive payment plans, making property investment accessible for both local and international investors.

- No mortgage restrictions for foreigners: Expatriates and foreign investors can secure mortgages easily, with banks offering up to 80% financing.

This affordability, combined with high quality and modern infrastructure, makes Dubai real estate a compelling investment.

6. World-Class Infrastructure

Dubai is renowned for its world-class infrastructure, which enhances the city’s appeal to investors and residents alike.

- Modern transportation: The Dubai Metro, extensive road networks, and upcoming high-speed rail projects make commuting seamless.

- Smart city initiatives: Dubai is investing in AI-driven smart city technologies to enhance living standards.

- Healthcare and education: The city boasts top-tier hospitals and international schools, making it an ideal place for families.

This world-class infrastructure boosts property values and ensures high rental demand.

7. Strategic Location

Dubai’s location between Europe, Asia, and Africa makes it an essential hub for global trade, tourism, and business.

- Major global business hub: Home to major multinational companies and free trade zones.

- World-class airports: Dubai International Airport (DXB) and Al Maktoum International Airport connect to over 250 destinations worldwide.

- Time zone advantage: Dubai’s time zone allows businesses to operate seamlessly across Europe, Asia, and the Americas.

This strategic location makes Dubai a magnet for global investors.

8. Regulated Market

Dubai’s real estate market is highly regulated by the government to ensure transparency and protect investors’ rights.

- Dubai Land Department (DLD): Oversees all property transactions and regulations.

- Real Estate Regulatory Agency (RERA): Ensures fair practices and investor protection.

- Strict regulations on developers: Ensures that projects are delivered on time and meet quality standards.

This strong regulatory framework ensures that investors can invest with confidence.

9. Golden Visa

The UAE’s Golden Visa program provides long-term residency benefits for real estate investors.

- 10-year residency for investors: Those investing a minimum of AED 2 million in property qualify.

- Family sponsorship: Investors can sponsor their spouses, children, and even domestic workers.

- No minimum stay requirement: Unlike other residency programs, Golden Visa holders do not need to live in the UAE full-time.

The Golden Visa program makes Dubai an attractive option for long-term investors seeking residency benefits.

How Baytii Helps You Invest in Dubai Real Estate

Baytii offers end-to-end solutions for real estate investors in Dubai:

- Expert consultation: Market insights and investment strategies.

- Property selection: Curated listings that match your investment goals.

- Financing guidance: Assistance in securing the best mortgage rates.

- Legal support: Navigating property registration and documentation.

- After-sales services: Property management and rental assistance.

Ready to invest in Dubai real estate? Contact Baytii today and start your journey towards a profitable investment!

Related Articles

Escrow Accounts in Dubai: How They Protect Your Real Estate Investment

Dubai has become one of the world’s most attractive destinations for real estate investors. With strong government regulations, clear processes, and transparent systems, property buyers often ask: Is real estate investment in Dubai safe? One of the key answers lies in the Escrow account system. This article explains what an Escrow account is, how it protects buyers, and why it plays a major role in reducing risk in Dubai’s property market.

Residence Permits in Dubai Through Real Estate Investment: Everything You Need to Know

Dubai continues to be one of the most attractive destinations globally for real-estate investment — not only because of its world-class infrastructure and tax-friendly environment, but also because foreign investors can secure residence permits via property ownership. This article outlines the two main investment-linked residence routes in Dubai, details their requirements, explains how each works and highlights recent regulatory enhancements from the UAE government.

Dubai 2040 Urban Master Plan: A Vision That Will Reshape Real Estate Markets

Dubai has long been synonymous with bold urban planning, iconic architecture, and aggressive growth. The unveiling of Dubai’s 2040 Urban Master Plan marks its latest leap into long-term thinking, combining sustainability, smart infrastructure, and population management into a two-decade roadmap. As real estate stakeholders—investors, developers, homebuyers—seek to align with future trends, the 2040 plan offers both opportunity and risk.

In this article, we’ll explore:

- What the Dubai 2040 plan broadly entails

- Key mechanisms by which it can influence real estate supply, demand, and pricing

- Projected effects on ROI across residential, commercial, and mixed-use sectors

- Strategic considerations and warnings for investors

- How to position yourself now to benefit

Comments (0)

You need to be logged in to comment